Emir Reporting Template

Emir Reporting Template - Guidelines for reporting under emir. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Emir mandates reporting of all derivatives to trade repositories (trs). Reports must be filed using a. Trs centrally collect and maintain the records of all. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one.

EMIR reporting explained what you need to know

The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Trs centrally collect and maintain the records of all. Reports must be filed using a. Finally, the validation rules document contains also a template for.

EMIR Trade Reporting

Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Emir mandates reporting of all derivatives to trade repositories (trs). Reports must be filed using a. With.

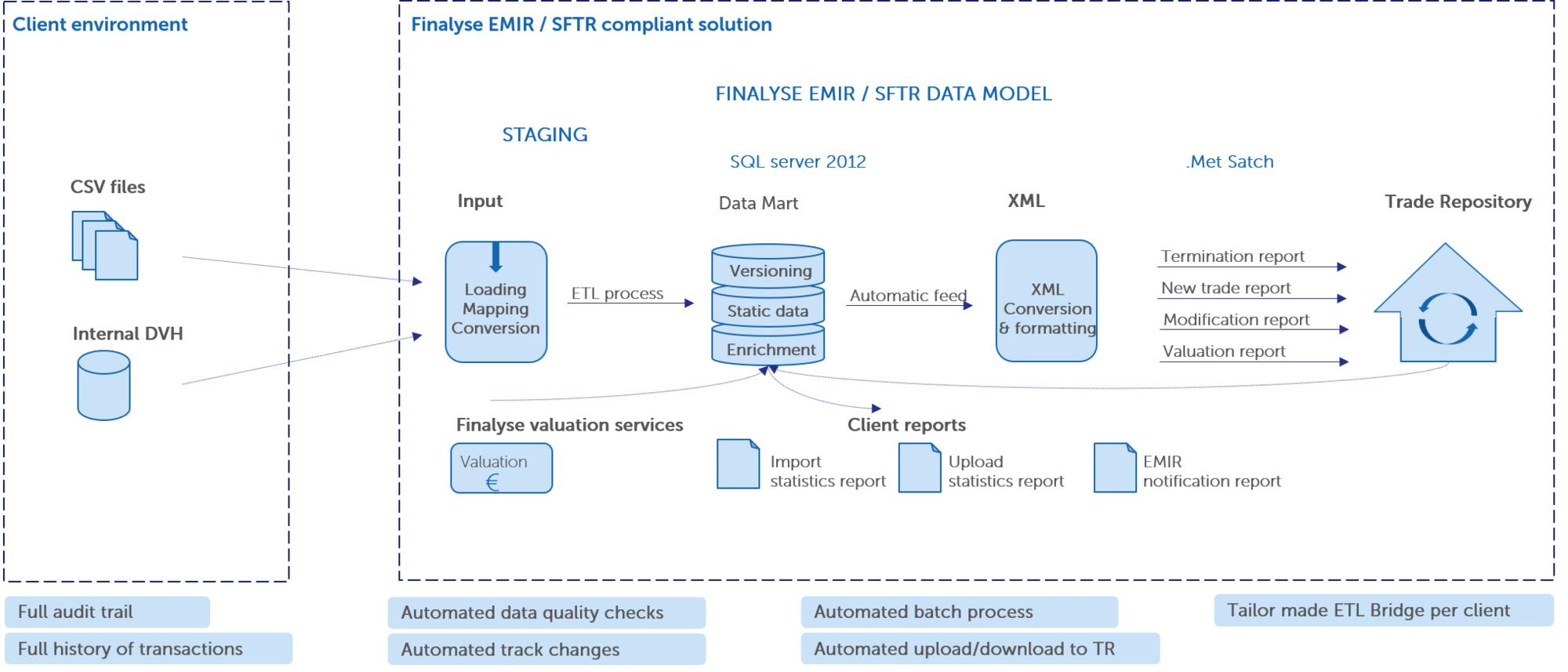

Finalyse EMIR Refit Reporting

Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Reports.

EMIR STRATEGY OTC LITE SOLUTION INTRODUCTION AND OVERVIEW

Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Guidelines for reporting under emir. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in.

Finalyse EMIR and SFTR Reporting Services Expert Valuation & Managed

Trs centrally collect and maintain the records of all. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Emir mandates reporting of all derivatives to trade repositories (trs). In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Introduction.

EMIR Trade Reporting

Reports must be filed using a. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Emir mandates reporting of all derivatives to trade repositories (trs). Trs centrally collect and maintain the records of all. With the implementation of the second emir refit, reporting to a.

ISDA/FOA EMIR Reporting Delegation Agreement

The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. Reports must be filed using a..

PPT CME European Trade Repository PowerPoint Presentation, free

Trs centrally collect and maintain the records of all. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Reports must be filed using a. With the.

This form will make you a derivatives star reporter PostTrade 360°

Guidelines for reporting under emir. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to.

EMIR Indicative reporting timeline updated by ESMA EMIRate

Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Emir mandates reporting of all derivatives to trade repositories (trs). Emir establishes the reporting obligation on both.

Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas. With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. The european securities and markets authority (esma), the eu’s financial markets regulator and supervisor, is clarifying. Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Emir mandates reporting of all derivatives to trade repositories (trs). Trs centrally collect and maintain the records of all. Reports must be filed using a. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Guidelines for reporting under emir.

Trs Centrally Collect And Maintain The Records Of All.

Introduction on 21st january 2017 the revised rts and its on reporting under article 9 of emir were published in the. Reports must be filed using a. Emir mandates reporting of all derivatives to trade repositories (trs). Guidelines for reporting under emir.

The European Securities And Markets Authority (Esma), The Eu’s Financial Markets Regulator And Supervisor, Is Clarifying.

With the implementation of the second emir refit, reporting to a trade repository has become more extensive and standardized. In such context, this document aims at providing a detailed view of the reporting rules introduced by the revised standard and at consolidating the. Emir establishes the reporting obligation on both counterparties that should report the details of the derivative trades to one. Finally, the validation rules document contains also a template for notifications of reporting errors and omissions to the ncas.